Some Known Factual Statements About Amur Capital Management Corporation

Table of ContentsHow Amur Capital Management Corporation can Save You Time, Stress, and Money.What Does Amur Capital Management Corporation Mean?Indicators on Amur Capital Management Corporation You Need To KnowGet This Report about Amur Capital Management CorporationAmur Capital Management Corporation - The FactsWhat Does Amur Capital Management Corporation Do?

The firms we adhere to need a solid record typically a minimum of one decade of operating history. This means that the company is likely to have actually faced at the very least one economic decline and that management has experience with adversity in addition to success. We look for to leave out companies that have a credit high quality listed below financial investment quality and weak nancial stamina.A firm's capability to elevate returns regularly can demonstrate protability. Firms that have excess cash ow and solid nancial positions often choose to pay returns to attract and compensate their investors. Therefore, they're commonly less volatile than supplies that don't pay returns. But beware of reaching for high yields.

More About Amur Capital Management Corporation

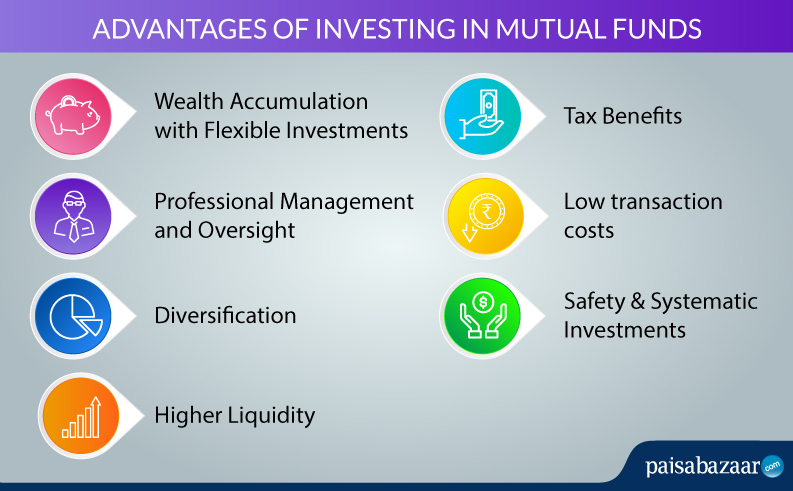

We have actually discovered these supplies are most in danger of reducing their returns. Expanding your financial investment portfolio can aid secure versus market uctuation. Take a look at the following variables as you plan to expand: Your profile's asset course mix is one of the most important consider determining efficiency. Consider the dimension of a firm (or its market capitalization) and its geographical market U.S., developed international or emerging market.

In spite of exactly how very easy electronic financial investment administration platforms have actually made investing, it should not be something you do on an impulse. If you choose to enter the investing world, one point to take into consideration is just how long you in fact want to spend for, and whether you're prepared to be in it for the long haul - https://amurcapitalmc.start.page.

There's an expression typical connected with investing which goes something along the lines of: 'the sphere may go down, yet you'll want to make sure you're there for the bounce'. Market volatility, when financial markets are going up and down, is a common phenomenon, and long-term can be something to assist smooth out market bumps.

Not known Details About Amur Capital Management Corporation

Joe spends 10,000 and gains 5% dividend on this investment. In year two, Joe makes a return of 525, due to the fact that not just has he made a return on his initial 10,000, however additionally on the 500 invested dividend he has actually made in the previous year.

Getting My Amur Capital Management Corporation To Work

One means you might do this is by getting a Supplies and Shares ISA. With a Supplies and Shares ISA. accredited investor, you can invest approximately 20,000 annually in 2024/25 (though this is subject to transform in future years), and you do not pay tax on any returns you make

Starting with an ISA is actually very easy. With robo-investing platforms, like Wealthify, the difficult work is done for you and all you need to do is pick just how much to invest and pick the risk level that matches you. It may be among the few instances in life where a less psychological method could be beneficial, however when it concerns your finances, you could wish to pay attention to you head and not your heart.

Staying concentrated on your long-lasting objectives might aid you to prevent illogical choices based upon your emotions at the time of a market dip. The data do not lie, and long-lasting investing can include several advantages. With a composed strategy and a lasting investment strategy, you might possibly expand even the smallest amount of financial savings right into a respectable amount of cash. The tax therapy depends upon your individual circumstances and may go through transform in the future.

Amur Capital Management Corporation Can Be Fun For Anyone

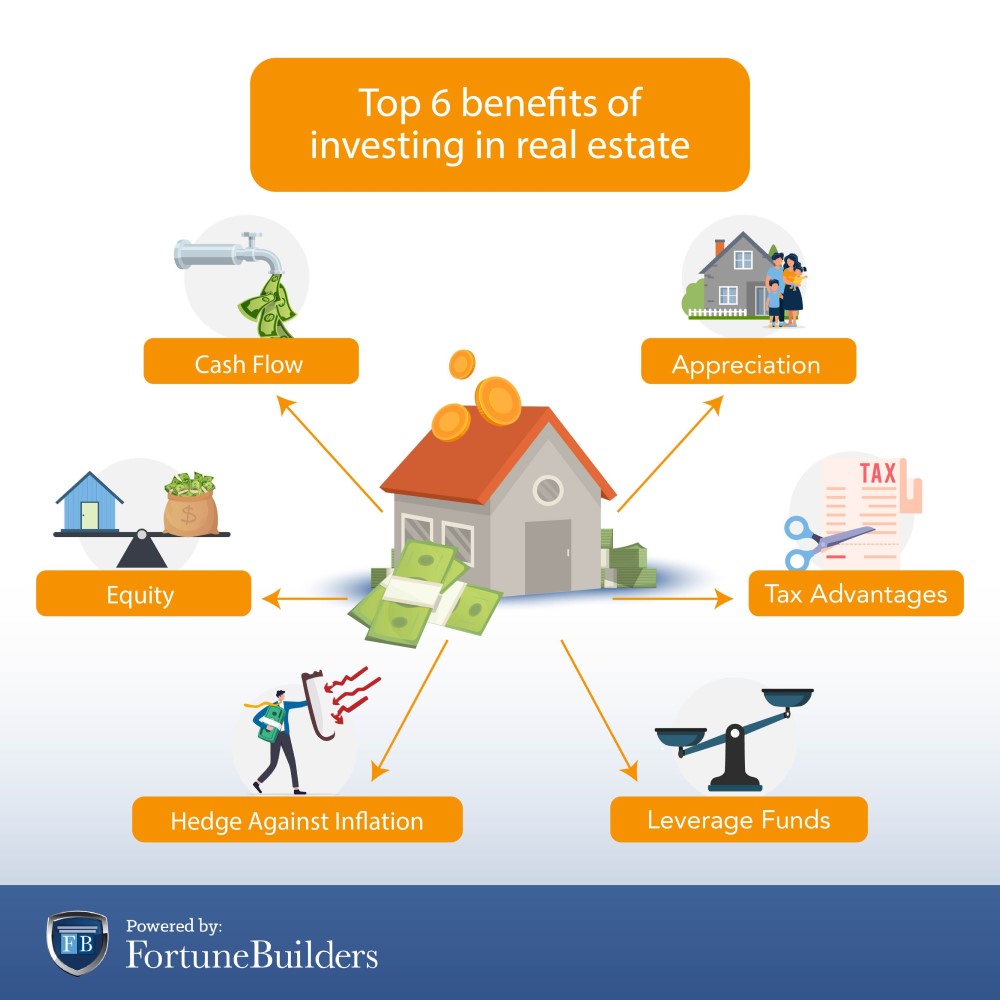

Spending goes one step better, assisting you attain personal objectives with 3 substantial benefits. While saving means alloting part of today's cash for tomorrow, spending methods placing your money to function to potentially earn a better return over the longer term - capital management. https://hearthis.at/christopher-baker/set/amur-capital-management-corporation/. Different courses of financial investment possessions cash money, dealt with interest, residential or commercial property and shares generally create different degrees of return (which is about the threat of the financial investment)

As you can see 'Growth' assets, such as shares and property, have actually historically had the very best general returns of all asset classes however have additionally had larger heights and troughs. As a financier, there is the potential to make resources development over the longer term as well as a recurring earnings return (like rewards from shares or lease from a residential or commercial property).

Our Amur Capital Management Corporation PDFs

Inflation is the continuous increase in the expense of living with time, and it can effect on our financial wellness. One way to assist outmatch inflation - and generate positive 'genuine' returns over the longer term - is by buying properties that are not simply with the ability of supplying greater revenue returns yet additionally provide the capacity for capital growth.